Financial Accounting

The Core of Corporate Financial Management

Adhering to the concept of lightweight, role-based, scenario-based, socialized, and intelligent, Yonyou financial accounting suite covers: general ledger, accounts receivable, accounts payable, fixed assets, inventory accounting, invoice and payment etc.

Why choose Yonyou?

Support your business with delicacy management

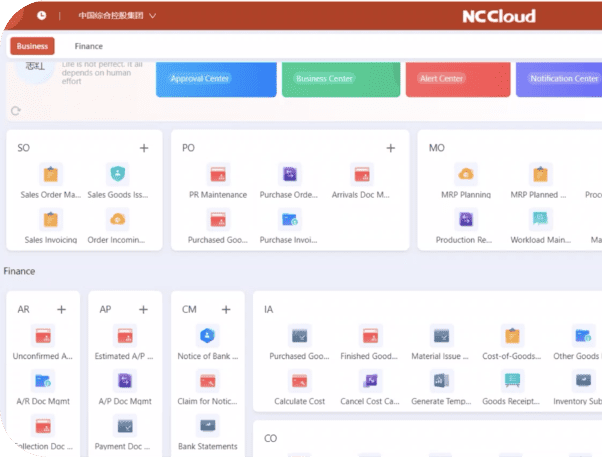

Financial accounting is the core of corporate finance. Yonyou’s financial accounting products cover general ledger, accounts receivable, accounts payable, fixed assets, inventory accounting, contract receipt and payment etc. Users can customize and design a dedicated interface. The system can be seamlessly integrated with 3rd party systems to provide flexible financial management solutions.

How can Yonyou help with your business needs?

Simplify accounting for your team

- Standardization of accounting terms, policies and procedures

- Accurate transaction reconciliation and collaboration

- Compliance with International Financial Reporting Standards

- Process simplification by integrating business, finance and tax

- Accurate control on the financial information of each company

- Capital and tax risk control by contract management

Features for greater efficiency

The business data is automatically converted into financial data through the accounting platform to realize the integration of business and finance. It supports operations in different aspects such as sales, shipment, invoicing, period-end processing etc., which improves the flexibility, ease of use and accuracy of revenue recognition.

Through the management of payables and receivables, the solution supports cash forecasting and cash management. It also helps financial managers to the status of invoices and track payments in real time.

Support internal settlement of purchase, sales, raw material picking, warehousing, supplier deposit, account receivables and payables, general ledger and automatic reconciliation of internal transactions, etc.

Real-time and automatic generation of financial reports through configurable number functions, semantic models, and financial modelling.

RPA applications include monthly closing robot, reporting robot, invoice verification robot, bank reconciliation robot. VPA voice interaction improves user experience. Financial self-service analysis is based on financial big data, which helps the financial team to establish analysis models.

RPA applications include monthly closing robot, reporting robot, invoice verification robot, bank reconciliation robot. VPA voice interaction improves user experience. Financial self-service analysis is based on financial big data, which helps the financial team to establish analysis models.

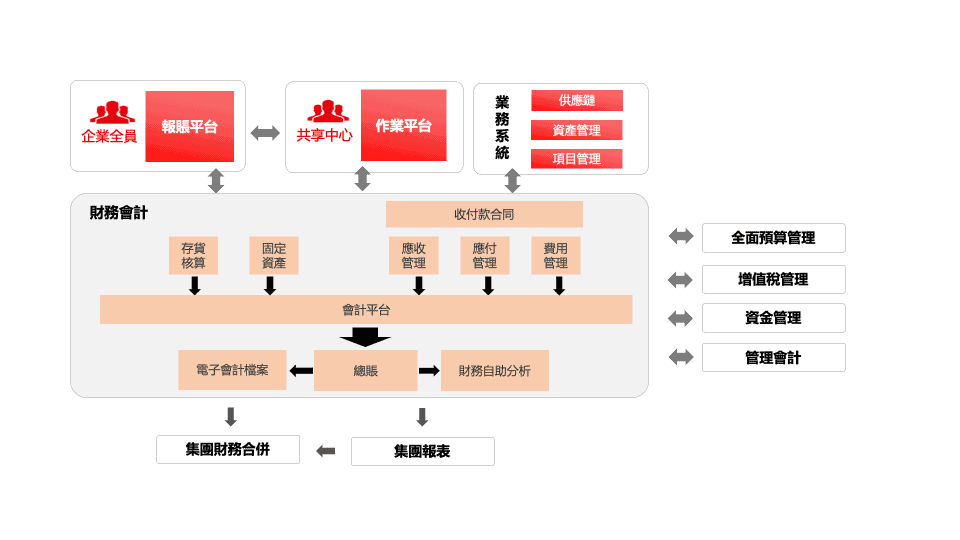

Solution architecture

The architecture of the financial accounting solution